Federal Reserve Holds Steady on Interest Rates Amidst Economic Uncertainty

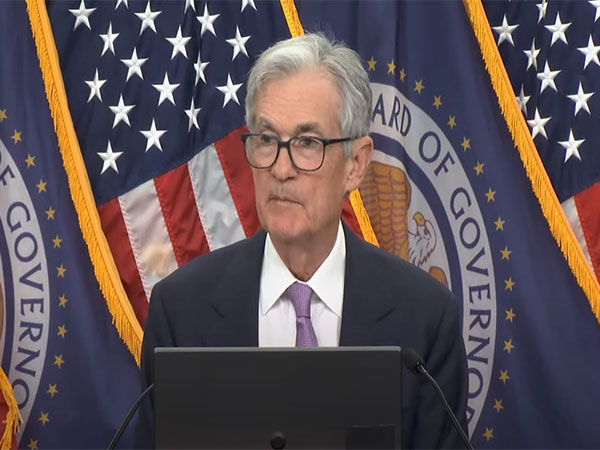

The US Federal Reserve has maintained its interest rates at 4.25-4.50%, focusing on employment and inflation goals. Chairman Jerome Powell emphasized a cautious approach as economic conditions evolve. The Fed also highlights ongoing concerns over trade policies and inflation projections, with potential future rate adjustments under careful consideration.

- Country:

- United States

In a decisive move, the US Federal Reserve opted to keep its benchmark interest rates unchanged at 4.25-4.50% on Thursday morning, citing ongoing economic uncertainties and a commitment to its dual mandate of promoting maximum employment and stabilizing inflation. Federal Reserve Chairman Jerome Powell justified the decision, outlining the Fed's strategy to be prepared for economic shifts.

Powell remarked, "In support of our goals, today the Federal Open Market Committee decided to leave our policy interest rate unchanged. We believe that the current stance of monetary policy leaves us well positioned to respond in a timely way to potential economic developments." The Federal Open Market Committee (FOMC) assured ongoing evaluation of data and potential risks before altering rates further.

The Fed's Summary of Economic Projections (SEP) reveals a dip in GDP growth forecasts to 1.4% for this year and 1.6% for the following year. Private domestic final purchases showed robust growth, yet inflation remains above the 2% target. The SEP predicts a gradual decline in inflation, with external factors like tariffs influencing economic forecasts.

(With inputs from agencies.)

ALSO READ

India's Nominal GDP Growth Predicted to Plummet, Impacting Corporate Revenues

The Fed’s Tightrope: Balancing Growth and Inflation Amid Global Tensions

Sri Lanka's Economic Surge: Analyzing Monetary Policy and Inflation Trends

German Inflation Recovers to 2.0% in June

US STOCKS-S&P 500, Nasdaq poised to climb after inflation data; focus on bank earnings