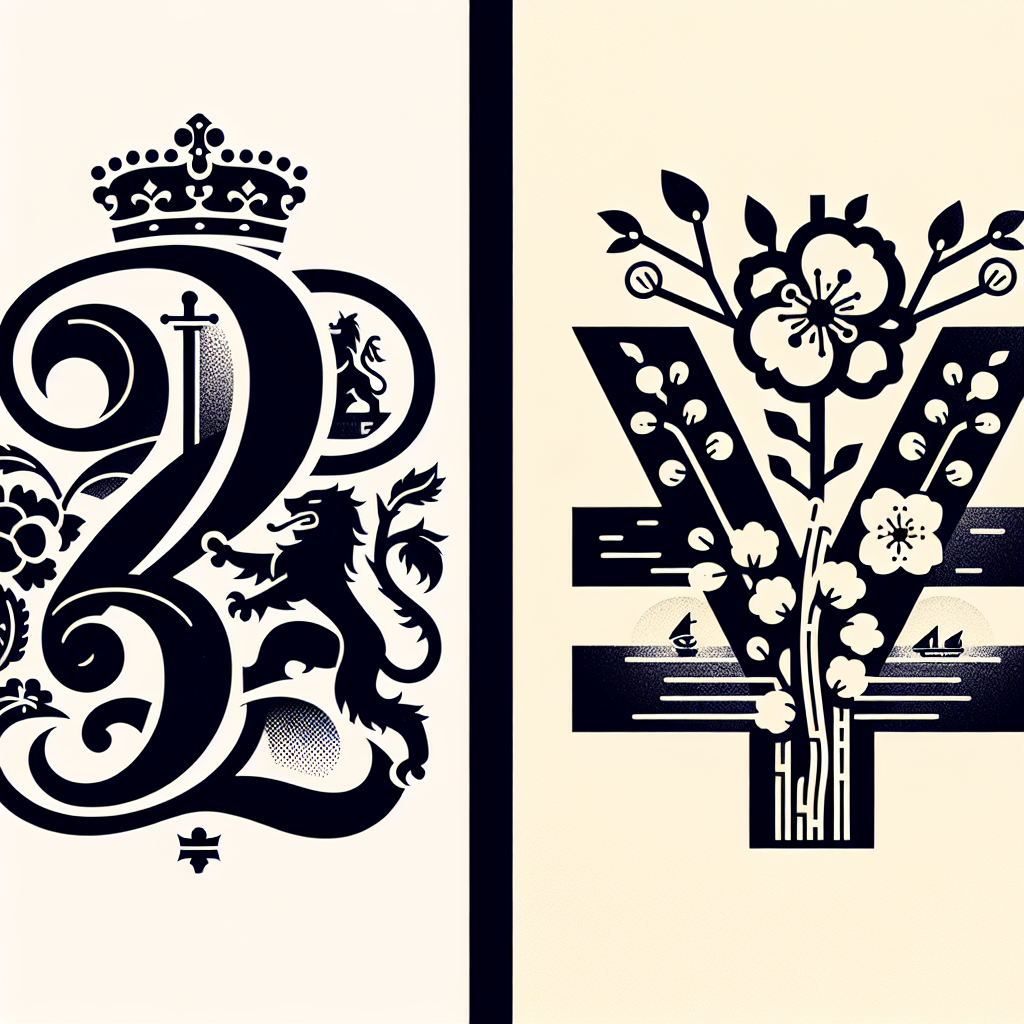

Global Financial Jitters: Pound and Yen Slump Amid Fiscal Woes

The British pound and yen face pressure as concerns grow over global government finances. Rising debt levels and political uncertainty in Japan have led to currency sell-offs, affecting market confidence. Investors are monitoring U.S. labor data that may influence Federal Reserve rate decisions amidst increasing bond yields.

The British pound and Japanese yen experienced significant pressure on Wednesday due to concerns over the stability of global government finances. Investors are increasingly worried about the rising debt across major economies, which has led to a sell-off in government bonds in both Europe and the U.S.

In the UK, the pound suffered a decline of over 1% on Tuesday, triggered by concerns about Britain's fiscal health, recalled from the Liz Truss episode. As the cost of 30-year borrowing soared to heights not seen since 1998, market confidence waned further.

Meanwhile, the Japanese yen saw a drop amid political uncertainty following the resignation intent of a key figure close to Prime Minister Shigeru Ishiba. This instability is contributing to the yen's downturn and affecting investor sentiment in Japan and beyond.

(With inputs from agencies.)

ALSO READ

Emaar Misr's Ambitious Red Sea Venture: A Boost to Egypt's Economy

Romania's Coalition Government Endures No Confidence Votes Amid Fiscal Reforms

US Treasury's Warning: Russian Economy Faces Collapse

Union Government Boosts Pulikali Mahotsavam with Historic Funding

Maharashtra's Government Resolutions Get a Modern Makeover