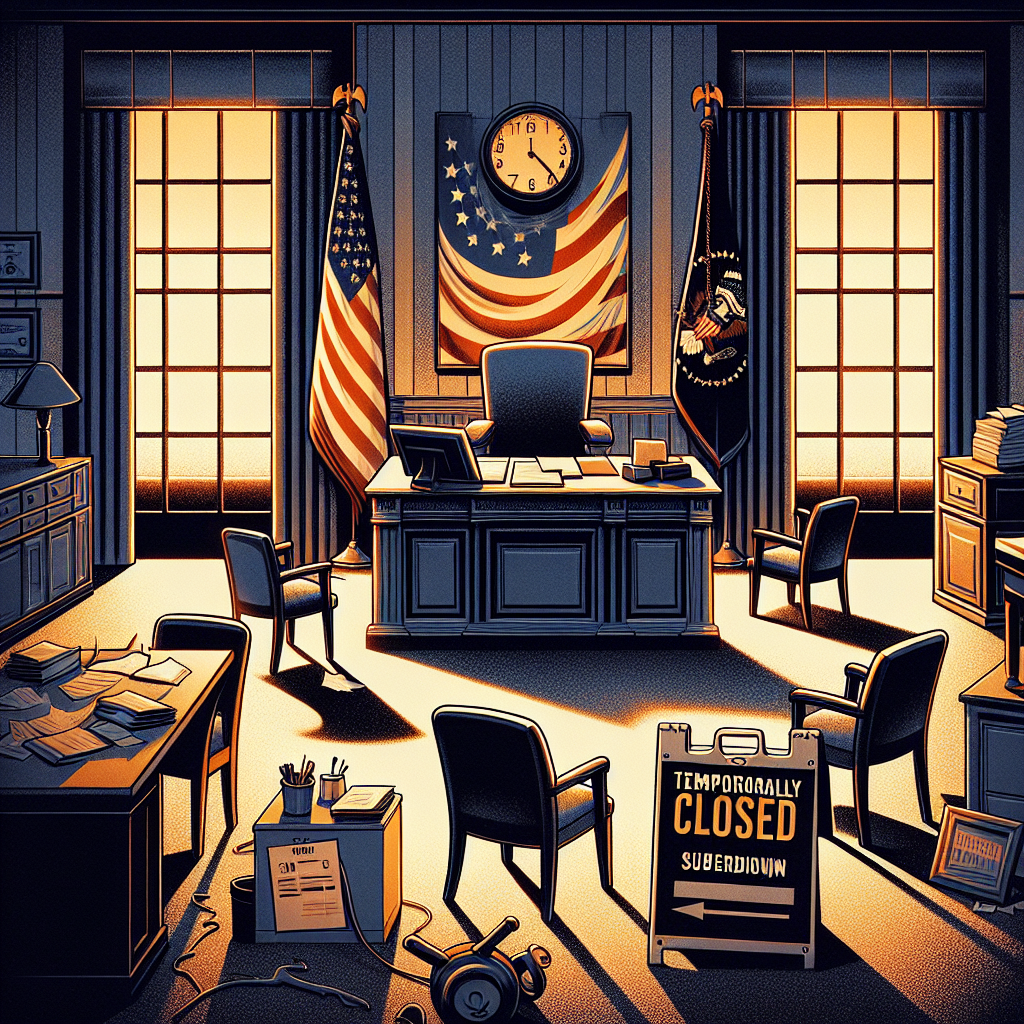

Economic Ripple Effects Loom Amid U.S. Government Shutdown

Wall Street futures dropped as a U.S. government shutdown threatens to delay job data and impact interest rate forecasts. The Senate's rejection of a spending measure will cause agencies to cease non-essential functions. Asian markets hesitated, and the Federal Reserve may cut rates, stirring financial uncertainty.

Wall Street futures experienced a downturn on Wednesday due to an impending U.S. government shutdown, poised to delay critical job data and complicate interest rate predictions. Simultaneously, Asian markets displayed caution following a robust quarterly performance.

The Senate's dismissal of a short-term spending proposal triggered the shutdown, mandating government agencies to halt all except essential operations, disrupting sectors ranging from air travel to employment statistics. Following this development, S&P 500 and Nasdaq futures each decreased by 0.4%, while gold prices slightly rose to $3,865 per ounce, nearing its peak from Tuesday.

Amid the absence of Friday's non-farm payrolls report, investors are likely to focus on the upcoming ADP National Employment Report. Experts forecast a modest addition of 50,000 private-sector jobs. Analyst Kyle Rodda highlighted potential market impacts, referencing President Trump's layoff threats which could amplify labor market volatility. Current futures suggest a 96% likelihood of an October Federal Reserve rate cut.

(With inputs from agencies.)

ALSO READ

Al-Ittihad's Stumble in Asian Champions League: Shabab Al-Ahli Seizes Victory

Surekha Yadav: Pioneering the Tracks as Asia's First Woman Loco Pilot

India's Swimmers Shine at Asian Aquatics Championships

Protest Over Asia Cup: Shiv Sena Worker Vandalizes TVs in Thane

Markets on Edge: U.S. Government Shutdown Looms