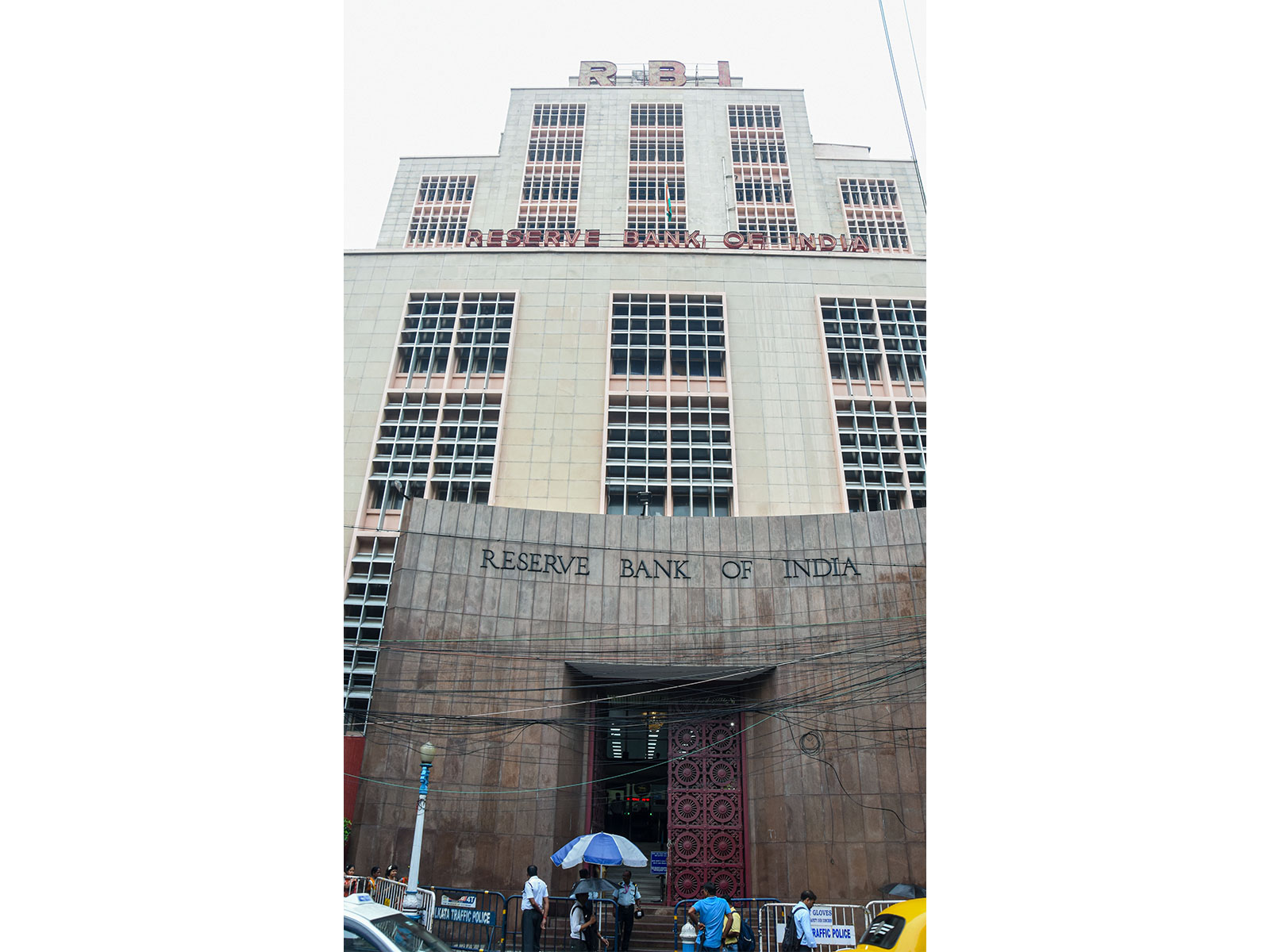

RBI's Measured Move: Repo Rate Holds Steady Amid Economic Volatility

The Reserve Bank of India's decision to maintain the repo rate at 5.5% reflects a strategic and balanced approach, addressing growth and inflation issues. This pause aims to boost consumer confidence and market stability, supported by rising GDP forecasts and stable inflation outlook amidst global economic uncertainties.

- Country:

- India

Industry experts have broadly commended the Reserve Bank of India's (RBI) decision to maintain the repo rate at 5.5%, citing it as a prudent move in today's economic climate. Manoranjan Sharma from Infomerics Valuation and Ratings highlighted its necessity amid ongoing growth and inflation trade-offs, aligning with economic realities.

Sharma pointed out that the decision underscores RBI's strategic policy calibration to manage inflation while fostering growth. Anshuman Magazine from CBRE acknowledged the decision's significance ahead of the festive season amidst global volatility, which is expected to enhance consumer sentiment and key sector demand.

Jyoti Prakash from AlphaaMoney flagged concerns regarding future U.S. tariffs affecting India, suggesting that rate adjustments might follow a trade deal. Meanwhile, analysts like Samantak Das from JLL perceive the unchanged rate as a signal of confidence, allowing previous rate impacts and GST adjustments to take effect fully.

Jyoti Prakash Gadia at Resurgent India remarked on incomplete rate cut transmissions, seen as justification for the RBI's pause. Shubham Gupta of Growthvine Capital noted the dovish undertone in upwardly revised growth forecasts and lowered inflation predictions, favorable for the bond market and domestic demand, despite U.S. tariff concerns.

Mayur Modi from Moneyboxx Finance supported the CRR cut, viewing it as beneficial for MSMEs and liquidity improvement. Anantharam Varayur from Manasum Senior Living homes commented that RBI's stance predicts stable borrowing costs, favoring growth sectors like senior living housing.

(With inputs from agencies.)

ALSO READ

Inflation down considerably, does open up space for monetary policy easing: RBI Guv Sanjay Malhotra.

RBI Adjusts Growth and Inflation Projections Amid Economic Shifts

Colombia's Central Bank Pauses Interest Rate amid Inflation Concerns

German Inflation Surpasses Expectations, Stirring Economic Concerns

Rising Inflation in Germany: A New Turn for the Euro Zone