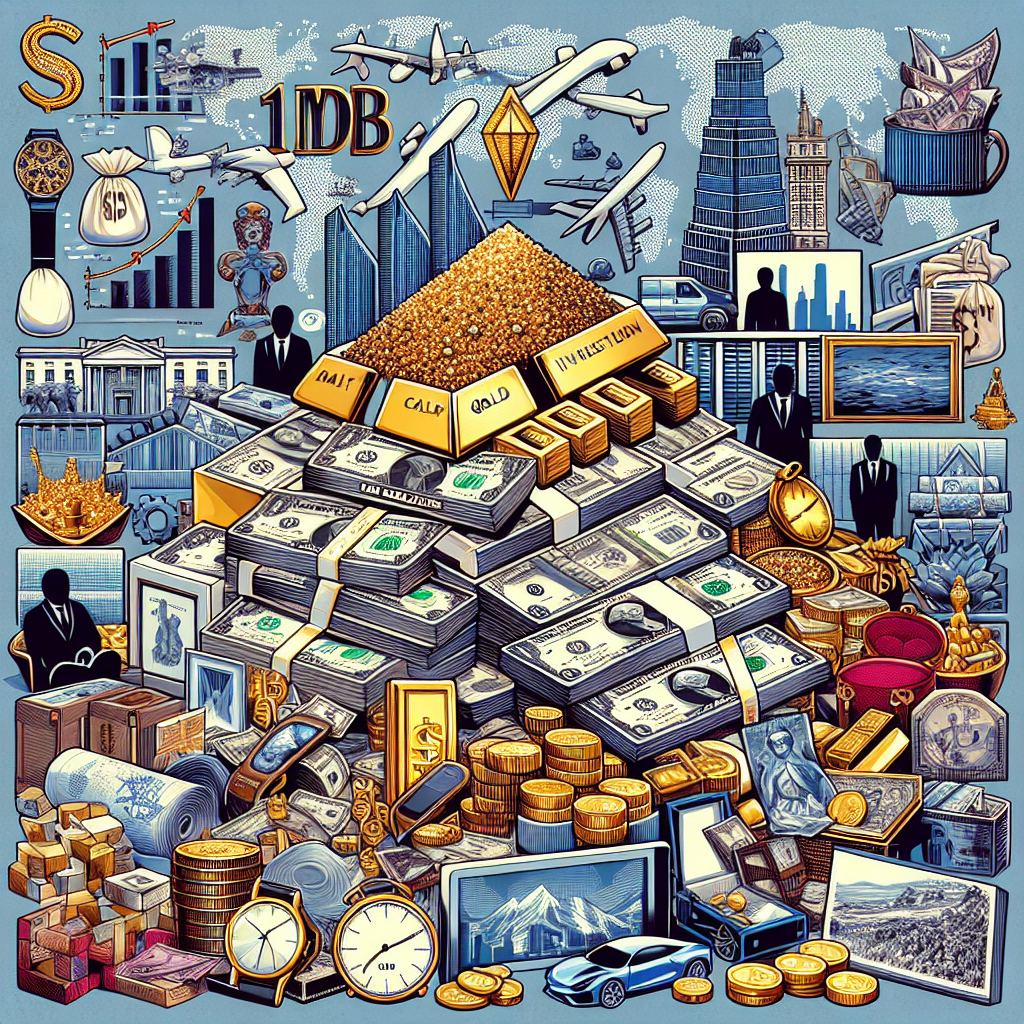

Sovereign Scandal: 1MDB vs Standard Chartered in Legal Battle

Liquidators for Malaysia's 1MDB have sued Standard Chartered in Singapore, alleging it enabled a massive fraud leading to over $2.7 billion in losses. The lawsuit claims the bank overlooked red flags in illicit fund transfers. Standard Chartered denies the allegations, which relate to the global 1MDB scandal.

Liquidators seeking to recover stolen funds from Malaysia's 1Malaysia Development Berhad (1MDB) have launched a legal battle against Standard Chartered Bank in Singapore. The lawsuit accuses the bank of enabling a massive fraud that led to financial losses exceeding $2.7 billion, linked to the infamous 1MDB scandal.

The allegations center on over 100 intrabank transfers between 2009 and 2013, which liquidators claim helped conceal stolen funds. They argue that Standard Chartered ignored evident red flags, facilitating the misappropriation of public money by high-level government operatives.

While Standard Chartered dismisses the lawsuit as meritless, asserting it will vigorously defend itself, the case highlights the global repercussions of the 1MDB fraud. As investigations continue in Singapore and elsewhere, the spotlight remains on financial institutions suspected of failing in their oversight roles.

(With inputs from agencies.)

ALSO READ

UK, Singapore, Hungary lead fintech innovation through regulatory sandboxes

Coastal Concerns: Debris from Singaporean Cargo Ship Washes Ashore

Singapore Shopping Theft: Indian Women Caught and Penalized

Silence in the Skies: Singapore Airlines' Role in Air India Crash Under Scrutiny

Najib Razak's Legal Saga Continues: A Temporary Reprieve in 1MDB Scandal