Eleventh-Hour Changes: GOP Tax Cut and Immigration Bill Shifts

Republicans made last-minute adjustments to their tax cut and immigration bill to gain support from GOP holdouts. Changes include removing sections for public land sales, renaming investment accounts, accelerating Medicaid work requirements, adjusting SALT cap, deregulating gun silencers, and creating a fund for border security reimbursements.

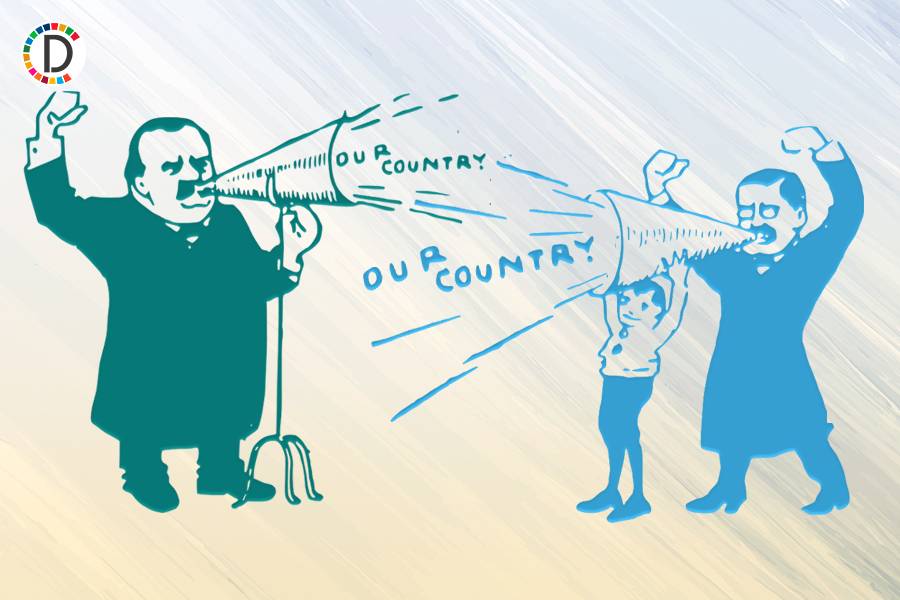

- Country:

- United States

In an attempt to secure passage through the House, Republicans introduced last-minute alterations to their sweeping tax cut and immigration bill late Wednesday. The revisions aim to sway GOP holdouts by addressing critical concerns.

Key modifications to the bill include the removal of sections authorizing public land sales in Nevada and Utah, discontinuing objections from western state lawmakers. A contentious investment account title change from "MAGA" to "Trump" was also enacted. Medicaid work requirements for certain beneficiaries were advanced to December 2026.

With an expanded state and local tax deduction, the SALT cap increases to USD 40,000 for households earning up to USD 500,000—a move to placate members from high-tax states. Additionally, the bill seeks to deregulate gun silencers, maintain federal worker pension calculations, and bolster border security funding.

(With inputs from agencies.)